For those who have been active in the markets for a quarter-century or more, it’s difficult to find anything unique. But when it comes to options, the list of strategies is enormous. These include such methods as bull put spreads, butterflies, iron condors, bear call spreads, straddles, strangles, etc. Then, there are variations. Here, we’ll look at one variation of the classic straddle called the scantily clad straddle.

The scantily clad straddle is a premium-capturing program that involves selling the straddle and then placing orders in the underlying commodity to provide a level of coverage should the underlying move significantly in one direction.

The scantily clad straddle can be used in any market that has options, including futures, forex, stocks and bonds.

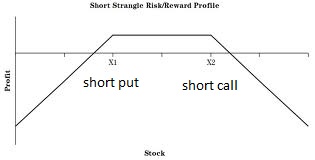

For those new to options, a straddle is a trade that engages both at-the-money put and call options. If the S&P 500 futures are trading at 1,000, then selling the straddle would involve selling the 1,000 put and the 1,000 call. A long straddle would purchase both options. A straddle is usually a volatility play rather than a directional trade, with a long straddle betting on an increase in volatility and a short straddle, a decrease in volatility. Many trading platforms let you sell the straddle instead of executing each leg of the trade separately. By selling the straddle, you collect the option premium. You are thereby naked the straddle.

It’s nice to collect the premium, but the danger is that the underlying market will move enough that the option buyer can execute against you. When selling options, the exposure is technically unlimited. Taking the above example, if you collected 50 points for the straddle, but the S&P 500 dropped to 800, the put would then be worth at least 200 points and you would be down at least 150 points. At $50 per point, that’s $7,500. The loss could be more, depending on how much time value is remaining on the options.

Dressing up

The scantily clad straddle offers a level of protection for the options positions — thus, the position is no longer naked. Applying this to the previous example, if we got 25 points for the call and 25 points for the put, a pair of good until canceled stop orders in the S&P 500 would be appropriate (see "Protective orders," below). The orders would be:

- Buy one S&P 500 E-mini at 1025 stop GTC

- Sell one S&P 500 E-mini at 975 stop GTC

Once the straddle has been sold and the orders have been placed, there are three basic scenarios in which the trade makes a profit. In the perfect scenario, the market stays below 1025 and above 975. The trade collects the entire option premium on one side and part of or the entire option premium on the other side, depending on the close at expiration. If, in this case, the market closed at expiration at 1002, then the entire put premium was retained and 23 of the 25 points of the call premium were captured.

However, it is unusual that neither of the stops were hit. What normally happens is a trend develops in at least one direction during the trade’s life. In "Hit the stop" (below), it is assumed that the buy stop was hit and executed at 1025.

On the day of expiration, the market is at 1054. The call expires being worth 54 points. It was sold for 25 points, resulting in a loss on the call option of 29 points. However, you went long the S&P 500 at 1025, and it closed at 1054. The resulting gain on the S&P was 29 points. The long trade covered the call position. The other thing to remember is you collected all of the 25 points on the put. As long as the market remains above the put’s 975 strike price, the position will make money (see "On expiration," below).

Anything above 975 is profitable. Every price above 1000 achieves the maximum profit of 25 points ($1,250). If the market trends strongly in the direction of the initial stop, the trade will be profitable. Unlike other option writing programs that get hammered during a trend, the scantily clad straddle loves trending markets. It locks in the profit and covers the losing side.

Finally, instead of the market hitting your 1025 buy stop, let’s say it went down and engaged your sell stop at 975 and then continued down and closed at 900 on the day of expiration. You’d lose 75 points on the put (100 points value at expiration minus the 25 points collected in premium). But you’d also make 75 points on the short sale and wash out the put loss. Then you’d gain all 25 points on the call option because it expired worthless.

The downside

To my knowledge, there is no perfect system. Every trading method has losing scenarios, and this includes the scantily clad straddle. There are two basic situations where the trade loses money: Gaps and whips.

With a price gap, the market jumps past your stop and executes you at a worse price than you were expecting (see "Leaping to losses," below). In the chart, the market gaps past the 1025 buy stop and gets filled at 1041. This additional 16 points from the original stop costs you $800 more on the trade. In this situation, the trade still made money ($450) because the put expired worthless and you kept the entire $1,250 premium. But if it had opened at, say, 1060, the entire trade would have been at a loss. Because of this risk, it’s advisable not to use this strategy with commodities known to have locked limit days, such as lumber, hogs, corn, etc. It works best with liquid markets like the E-mini S&P 500.

Another scenario that ends in a loss is a whip trade. This occurs when both buy and sell stops are hit. When the second one is hit, then the entire trade is exited. This involves buying back the straddle. The resulting loss is dependent on how much time premium is left in the options. The earlier the whip occurs in the trade’s life, the bigger the loss, as opposed to a whip occurring with only 10 days remaining in the option’s life.

The most catastrophic situation is a whip with double gap fills beyond each stop. This would be an extremely rare occurrence, but it still must be considered a possibility as you evaluate this strategy.

Finally, because stop orders are being used, there will be times that you’ll get slippage (the order is filled at worse than your stop price). If, on expiration day the futures price closes near the strike, it may not be clear whether the option will get exercised. You don’t want to come in on Monday thinking you had a profitable trade only to find out you’re long the S&P 500 and it dropped Sunday night by 50 points. Sometimes, it’s better to buy back at least one leg of the option right before expiration just to avoid this scenario.

Be sure to cancel the related standing stop orders when the trade is completed. Also, if the futures month is not expiring, then the option is not a cash settlement, but the option is exercised and you’ll be long or short the underlying commodity.

There are situations in which the price might close just in the money for the option, but is not exercised. This happens because the option owner has several hours to make up his or her mind on whether to exercise the option. In after-hours trading, the commodity might move against the option owner to where it’s not profitable to exercise. When the price is close to the strike, it is best to exit the position. It will cost you a little, but will provide some peace of mind.

Bond trade

In Treasury bonds, the strikes are in full handles (129, 130, 131, etc.). The options trade in 64ths. T-bond futures trade on a quarterly cycle: March, June, September and December, but include serial options that trade every month. The November options are based on the December futures. Options expire the month before, meaning the November options expire in October.

In mid-September, the November T-bond option straddle with a strike price of 130 was sold. The December T-bond futures contract, the underlying for the November options, was trading around 129-28/32. The premium collected was 2-17/64 for the call and 2-23/64 for the put. This resulted in a total collected premium of 4-40/64, or $4,625. Once filled, two stop orders were placed:

- Buy one December T-bond futures at 132-09/32 stop GTC

- Sell one December T-bond futures at 127-20/32 stop GTC

The placement of the stop was equal to the distance of the strike price and the premium collected: Call premium of 2-17/64 plus 130 strike for a buy stop of 132 9/32; then 130 strike minus put premium of 2-32/64 for a sell stop of 127-20/32.

A few days later, the bonds moved higher and hit the buy stop at 132-09. The bonds continued their climb to 135-12. During this phase, we’re pretty happy with the trade. The call has been covered by the long position. If the bonds stay above the strike price of 130, now five points away, the trade will be profitable. Then the price started dropping and returned to the high 130 area. On November options expiration, December T-bond futures closed at 131-20. The results were as follows:

Call optionSold: 2 17/64

Expired: 1 40/64

P/L: +41/64 (+$640.63)

Expired: 1 40/64

P/L: +41/64 (+$640.63)

Put optionSold: 2 23/64

Expired: 0

P/L: +2 23/64 (+$2359.38)

Expired: 0

P/L: +2 23/64 (+$2359.38)

Futures tradeLong: 132 9/32

Exit: 131 20/32

P/L: -21/32 (-$656.25)

Exit: 131 20/32

P/L: -21/32 (-$656.25)

ResultCall option: + $640.63

Put option: + $2,359.38

Futures trade: - $656.25

Total P/L: +$2,343.76

Put option: + $2,359.38

Futures trade: - $656.25

Total P/L: +$2,343.76

Other elements can be calibrated to fine tune the strategy, such as time frame and volatility. However, this basic concept is straightforward and successful.